Responsible Borrowing Practices

To make positive that small loans work for the borrower instead of in opposition to them, adopting responsible borrowing practices is essential. First, accurately assessing one's financial situation is vital. Before applying for a loan, borrowers should decide how much they'll afford to borrow and repay with out jeopardizing their financial wellbe

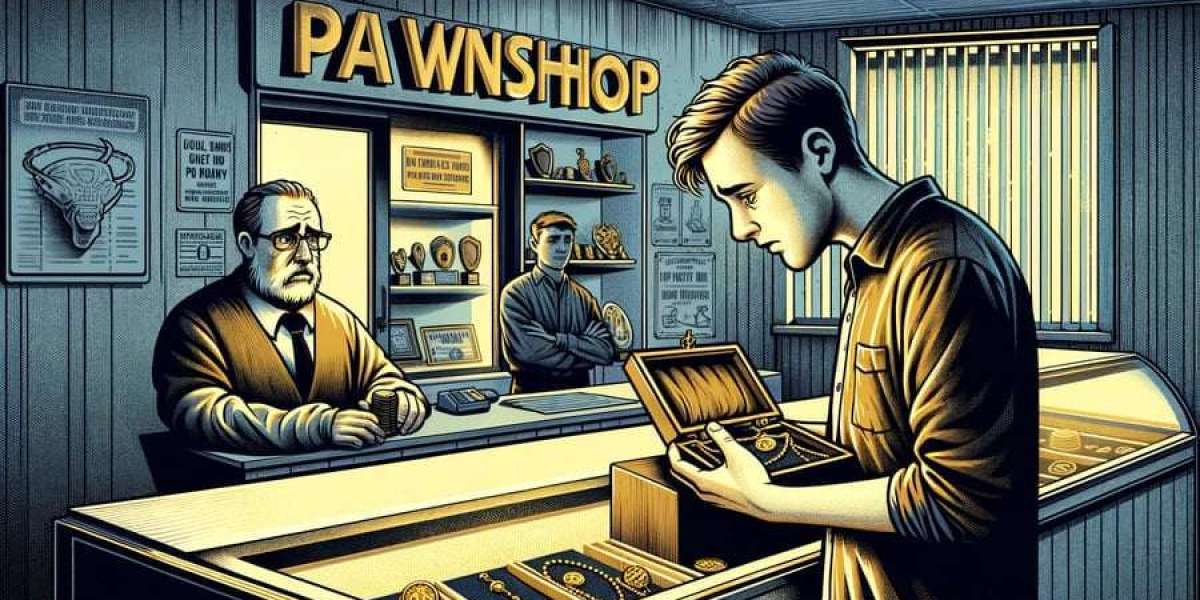

Pawnshop loans are straightforward transactions. When an individual needs money, they'll go to a pawnshop and provide an merchandise of value—such as jewellery, electronics, or collectibles—as collateral. The pawnshop appraises the merchandise and provides a loan quantity based mostly on this appraisal. Typical mortgage amounts range from 25% to 60% of the merchandise's worth. Once the loan terms are agreed upon, the borrower receives money on the spot, and the pawnshop holds the collateral till the mortgage is rep

If you are unable to repay your pawnshop mortgage throughout the specified period, the pawnshop retains the proper to maintain the pawned item. They can then sell it to recover their losses. It's crucial to review the particular phrases of the loan settlement to know potential consequen

Additionally, some lenders may charge hidden charges, which might considerably enhance the total cost of the loan. It is crucial to read all loan agreements carefully and inquire about any potential charges before committing. Lastly, small loans can sometimes be perceived as predatory, particularly when provided by less respected lenders. Borrowers must do thorough research to ensure they are coping with trustworthy instituti

Moreover, mobile loans usually come with user-friendly interfaces, making it easier for debtors to complete applications. Gone are the times of infinite paperwork; in many instances, all that's needed is a few faucets on a display screen. With cellular loans, customers can also manage their repayments and track their mortgage standing on-line, greatly enhancing their convenie

To retrieve the item, the borrower should repay the loan quantity plus any curiosity and fees inside a specified interval, usually 30 to 90 days. If the borrower can not repay the loan, the pawnshop retains possession of the collateral and might promote it to recoup their losses. This model makes pawnshop loans accessible to those that could have problem obtaining standard loans due to poor cre

Consider on the lookout for lenders who offer pre-qualification choices, which permit Visit Homepage potential borrowers to gauge their eligibility without affecting their credit score rating. This is a useful step in finding essentially the most appropriate Credit Loan for individual wa

Generally, a credit score of 600 or above is taken into account acceptable for most lenders when applying for Monthly Payment Loan loans. However, every lender has its personal standards, and a few may supply choices even to these with decrease scores. It’s best to examine particular person lender requirements earlier than apply

Additionally, debtors can keep away from falling into debt traps by considering various financial merchandise which will better suit their needs. Educating oneself about personal finance enhances long-term monetary well-being and contributes to more informed decision-mak

It's also essential to understand the importance of rates of interest and how they impression monthly funds. The price can differ considerably based mostly on creditworthiness, the sort of loan, and present market situations. Thus, exploring all available options is vital for minimizing total co

When navigating the world of real estate, understanding the intricacies of real estate loans is essential for each patrons and traders. These loans play a pivotal function in facilitating property purchases, renovations, and investments, enabling individuals to attain their financial goals by way of actual property. The complexity of various mortgage products and the ever-changing monetary panorama may be overwhelming. This article goals to simplify the often-confusing area of actual estate loans, providing insights that may empower you in making knowledgeable selections. Here, we'll cowl important matters, together with kinds of loans, key components to think about, and how professional resources like 베픽 can help you on your jour

Moreover, setting a budget to handle bills effectively can prevent the temptation to overspend. Once a small mortgage is secured, borrowers must prioritize repayment to avoid accruing extra debt. This vigilance in managing mortgage repayments may help keep a constructive credit score profile and in the end improve future borrowing prospe

Another advantage is the flexibility of usage; borrowers can utilize the funds for nearly any financial need, offering monetary freedom. This versatility is especially beneficial for these going through sudden bills or these trying to consolidate d

Whitney Hillard

9 مدونة المنشورات